Process

The Valley Wealth Management Group process creates investment plans that embrace our clients' dreams. Whether their dream is early retirement, leaving a legacy of charitable giving, or securing future generations' financial prosperity, we have tools in place designed to help get them there. Our process involves the use of these tools along with personalized investment choices vetted for their risk tolerance, tax bracket, and income needs, among other factors.

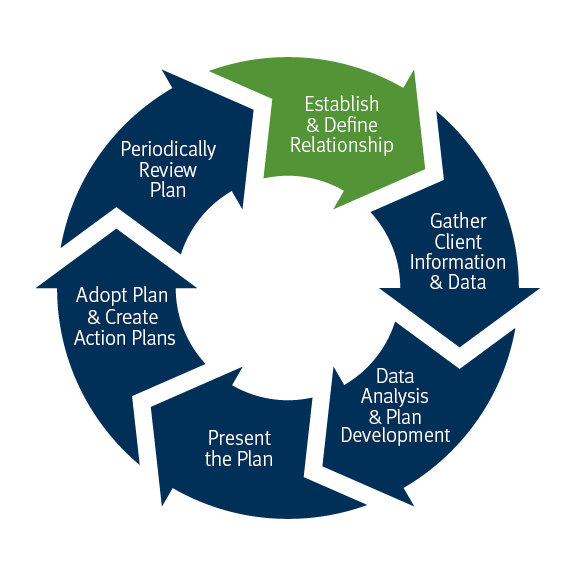

Wealth Management Process

Stifel’s wealth management process consists of six steps that help get an overview of your current situation, choices available, and what must be done to pursue goals. The process involves gathering relevant financial information, determining your organization’s goals, examining current financial status, and formulating a strategy or plan for how to work toward goals given the current situation and future plans.

• Take inventory of assets, including retirement plans

• Evaluate your income stream

• Buying a house

• Investing for college education

• Saving for retirement

• Inflation

• Risk tolerance

• Allocate funds among appropriate investment categories

• Respond to changes in objectives

• Fundamental changes in portfolio (values)

Stifel encourages investors to take control of their financial future. We have developed several services that are designed to help investors with many of the time-consuming details involved in investment planning and supervision.

Like a road map, an investment plan directs to a destination. The map, like the plan, isn’t useful until the destination has been decided — or in the case of investing, the long-term goals defined.

Setting specific goals is the most important step taken when developing your plan. A discussion of financial objectives and goals will provide an understanding of what hopes to be achieved. Any information discussed with Stifel Financial Advisors is kept confidential.

After the long-term goals have been defined, all that remains to be done is deciding the right mix of investments. The entire asset base must be considered. If part of a portfolio is not taken into account, a false picture will be presented.

One can potentially determine how much money can be accumulated over a lifetime from employment or other sources. That amount will remain constant as long as the variables do not change, such as employment. How successfully you invest your money may determine how you live during retirement.

Few things are more vital than knowledgeable investment planning. You can take control of your financial future by:

1. Developing an investment plan offering the greatest potential opportunity for pursing your financial goals;

2. Executing that plan;

3. Periodically reviewing that plan and making adjustments for changing financial objectives.

Investment planning and supervision can be time-consuming, but knowing a long-term investment plan is in place may help with your financial goals.

Because this process takes time, Stifel has designed various services to help investors with many of the details involved in investment planning and supervision.

Asset allocation and diversification do not ensure a profit or guarantee future results. There are no guarantees that the investment strategies mentioned will achieve their objectives.